Running a small business is both exciting and challenging. While passion, innovation, and customer focus are essential, it’s smart financial practices that ultimately determine whether a business thrives or merely survives.

According to data from the U.S. Bureau of Labor Statistics, nearly 20% of small businesses fail within the first year, and about 50% fail within five years—often due to poor financial management. Whether you’re just starting or aiming to scale, establishing sound financial habits can make all the difference.

In this comprehensive guide, we explore smart financial practices every small business should adopt to build a solid foundation, weather economic shifts, and pave the way for long-term success.

1. Separate Personal and Business Finances

Mixing personal and business funds is one of the most common—and risky—financial mistakes small business owners make.

Why it matters:

- Creates confusion during tax season

- Makes it difficult to track business performance

- Increases liability risk

Best practice:

Open a separate business bank account and credit card. Pay yourself a salary or draw instead of dipping into the business account for personal expenses.

2. Create a Realistic Budget (and Stick to It)

A budget is your financial roadmap. It outlines your income, expenses, and financial goals.

Why it matters:

- Helps control spending

- Prevents surprises

- Aligns spending with business priorities

Best practice:

- Base your budget on historical data and realistic projections.

- Include all recurring and variable expenses.

- Revisit and adjust monthly or quarterly.

3. Monitor Cash Flow Regularly

Cash flow is the lifeblood of your business. Even profitable businesses can fail due to poor cash flow management.

Why it matters:

- Ensures you can cover payroll, bills, and unexpected costs

- Helps identify when to cut spending or seek financing

Best practice:

- Use a cash flow statement to track incoming and outgoing funds.

- Forecast future cash flow to anticipate shortages or surpluses.

- Collect payments faster and delay non-essential expenses when needed.

4. Build and Maintain an Emergency Fund

A cash reserve can be the difference between survival and shutdown during slow months, recessions, or crises like a global pandemic.

Why it matters:

- Protects your business during unexpected downturns

- Reduces reliance on credit or high-interest loans

Best practice:

Aim to save 3 to 6 months’ worth of operating expenses in a separate account.

5. Control Operating Costs Without Cutting Corners

Running lean is smart, but cutting critical expenses can backfire.

Why it matters:

- Maintaining efficiency without sacrificing quality supports growth

- Helps improve profit margins

Best practice:

- Regularly audit expenses.

- Renegotiate vendor contracts.

- Automate processes to reduce labor costs.

6. Stay on Top of Invoicing and Receivables

Late payments can wreak havoc on cash flow.

Why it matters:

- Ensures steady revenue

- Avoids cash shortages

Best practice:

- Send invoices promptly.

- Set clear payment terms (e.g., Net 15 or Net 30).

- Use invoicing software with automatic reminders.

- Offer early payment discounts or charge late fees when appropriate.

7. Invest in Professional Accounting Tools or Services

You don’t have to be a CPA to manage your finances—but you need reliable tools and advice.

Why it matters:

- Reduces human error

- Saves time and money

- Ensures tax compliance

Best practice:

- Use tools like QuickBooks, Xero, or Wave for bookkeeping.

- Consider hiring a part-time bookkeeper or accountant.

- Schedule quarterly reviews with a financial advisor.

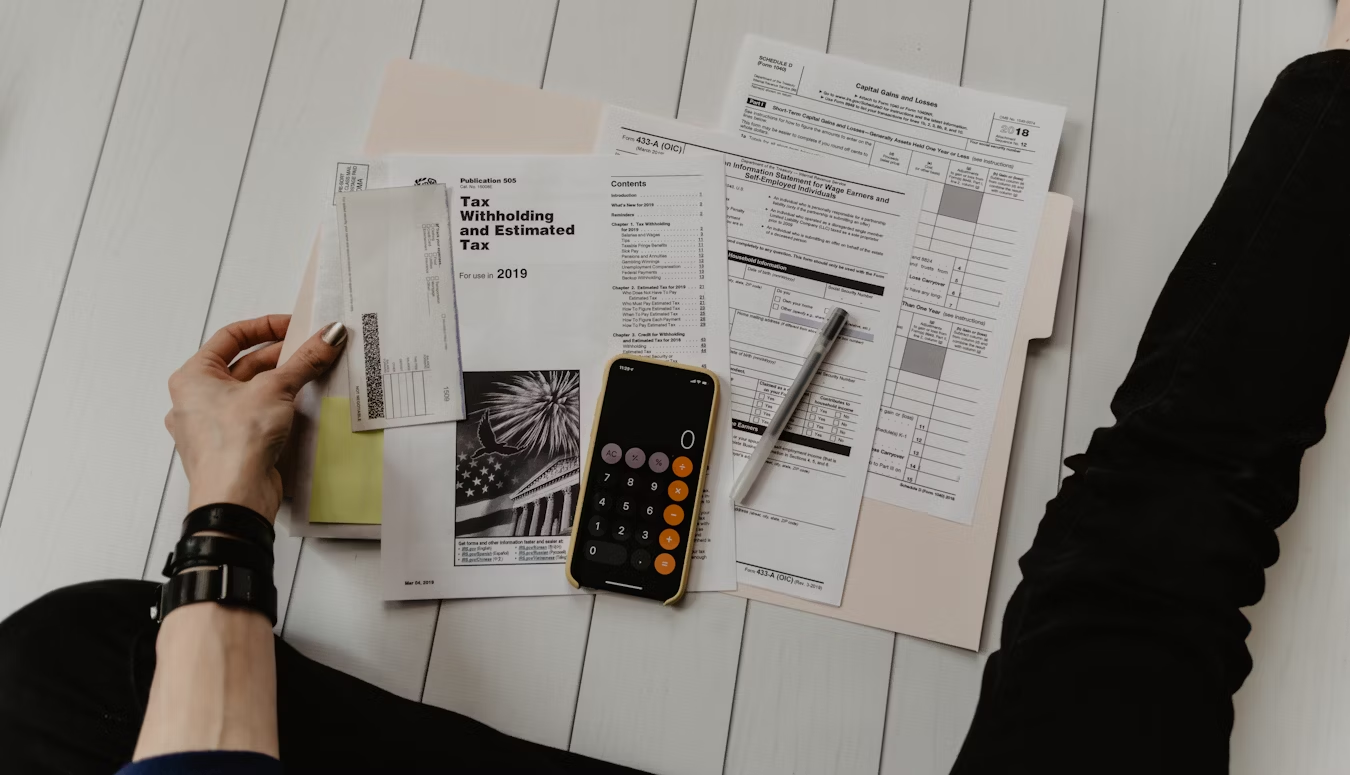

8. Understand Your Tax Obligations

Tax mistakes can be costly, both financially and legally.

Why it matters:

- Avoids penalties and interest

- Helps you take advantage of available deductions

Best practice:

- Stay current on local, state, and federal tax laws.

- Pay estimated quarterly taxes if required.

- Keep detailed records of expenses, receipts, and payroll.

9. Plan for Growth with Financial Forecasting

You can’t scale a business without a plan.

Why it matters:

- Prepares you for upcoming expenses

- Helps secure funding or attract investors

- Supports strategic decision-making

Best practice:

- Create financial projections for 12, 24, and 36 months.

- Factor in best-case, worst-case, and most likely scenarios.

- Use forecasting to plan hiring, inventory, and marketing.

10. Protect Your Business with the Right Insurance

Unexpected events like lawsuits, data breaches, or natural disasters can cripple your business.

Why it matters:

- Provides financial safety net

- Is often legally required depending on your industry

Best practice:

- Consult an insurance agent to understand your needs.

- Consider general liability, professional liability, property, and cyber insurance.

- Review and update coverage annually.

11. Reinvest Wisely Into Your Business

Smart reinvestment fuels innovation, efficiency, and customer satisfaction.

Why it matters:

- Drives sustainable growth

- Improves competitive edge

Best practice:

- Allocate a portion of profits to R&D, marketing, employee development, or new technology.

- Track ROI for each investment area.

- Don’t overextend—grow within your means.

12. Review Financial Reports Regularly

Financial statements tell the real story of your business health.

Why it matters:

- Helps spot trends and red flags early

- Supports strategic pivots

Best practice:

- Review profit & loss statements, balance sheets, and cash flow statements monthly.

- Compare actuals to budget and forecasts.

- Use insights to adjust goals or expenses.

13. Build Strong Banking and Credit Relationships

Access to capital is crucial—especially in times of growth or crisis.

Why it matters:

- Good banking relationships can improve loan approvals and interest rates

- Business credit affects your borrowing capacity and supplier relationships

Best practice:

- Build a relationship with a local business banker.

- Apply for a business credit card and make timely payments.

- Check and improve your business credit score regularly.

Conclusion: Discipline Is the Key to Financial Health

Financial success in small business doesn’t happen overnight. It comes from consistent, disciplined practices that prioritize clarity, control, and long-term thinking.

By applying the smart financial practices outlined in this guide, you’ll not only avoid common pitfalls—you’ll build a more stable, profitable, and scalable business.

Remember:

- Review finances regularly

- Ask for professional help when needed

- Plan ahead, but act with discipline today

Final Thought

Are you treating your business finances with the same attention you give your products, services, or marketing? If not, now is the time to start. Your business’s future depends on it.

Share this content:

Post Comment